Budgeting money stands as a fundamental prowess, endowing individuals with the prowess to steer their finances, realize aspirations, and erect a fortress of financial security. Whether the aim is to vanquish debt, amass funds for a monumental acquisition, or plot the course for retirement, fashioning and adhering to a budget emerges as imperative for managing income and expenditures sagaciously. In this discourse, we embark on a voyage through the significance of budgeting money and proffer pragmatic counsel for mastering this quintessential fiscal artistry.

The Significance of Budgeting Money:

Budgeting money underpins financial equilibrium and triumph, enabling you to:

Track Your Spending: A budget functions as a compass, illuminating the trajectory of your finances each month, affording you insights into areas ripe for paring down and economizing.

Set Financial Objectives: By crafting a budget, you can delineate precise financial milestones and earmark funds toward their fulfillment, be it the fortification of an emergency reserve, the accrual of funds for a sojourn, or the expunging of debt.

Evade Overspending: A budget empowers you to apportion your expenditures judiciously, steering clear of profligacy on non-essential trappings, ensuring that you reside within your means sans the accretion of gratuitous debt.

Steel Yourself Against the Unexpected: Budgeting enables you to squirrel away funds for unanticipated expenditures or exigencies, erecting a financial bulwark to weather contingencies such as vehicular repairs or medical exigencies.

Strategies for Budgeting Money Effectively:

Track Your Income and Outlays: Embark by cataloging all revenue streams, encompassing salaries, bonuses, and sundry sources of income. Subsequently, meticulously document your outlays by categorizing them into fixed expenses (e.g., rent or mortgage payments, utilities, and insurance) and variable expenses (e.g., groceries, dining out, entertainment, and discretionary spending).

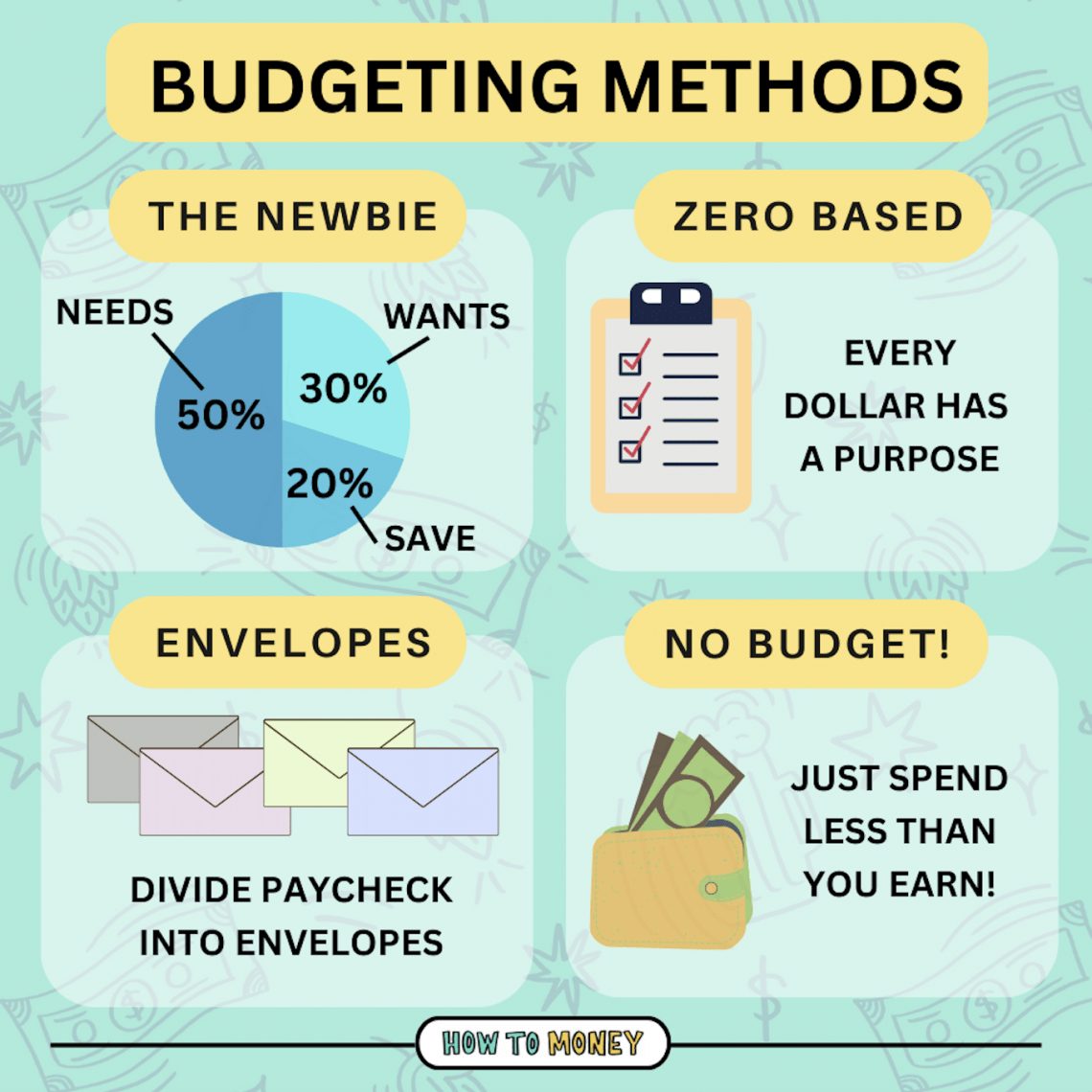

Construct a Budget:

Assign a fraction of your income to each expense category commensurate with your priorities and financial aspirations.

Ensure that the aggregate of your expenditures does not outstrip your total income, reserving leeway for savings and sundry financial objectives.

Leverage budgeting tools or applications to automatize the process and monitor your progression over time.

Pioneer Savings:

Elevate saving money to a preeminent position by earmarking a segment of your income for savings each month.

Aim to squirrel away no less than 10-20% of your income for protracted goals like retirement or a down payment on a domicile.

Contemplate instituting automatic transfers from your checking account to your savings repository to streamline the process of saving money.

Trim Expenditures:

Identify avenues where expenditures may be truncated and costs curtailed to liberate additional funds for savings or other financial aspirations.

Scout for prospects to excise redundant expenses such as dining out, subscription services, or impulse purchases.

Engage in negotiations with service providers to haggle down your bills or transition to more economical alternatives.

Review and Adjust:

Conduct periodic reviews of your budget to monitor your advancement and pinpoint any areas necessitating modification in expenditure or savings objectives.

Embrace flexibility and manifest willingness to effect alterations as warranted to remain aligned with your financial aspirations.

In denouement, budgeting money emerges as a potent implement for wresting command of your finances and realizing your financial aspirations. By monitoring your income and expenditures, erecting a budget, prioritizing savings, trimming expenses, and conducting regular reviews and adjustments, you can hone the craft of budgeting money and pave the trajectory toward a fortified financial future. Remember that budgeting is a skill that necessitates patience and practice to master, but with persistence and resolve, you can attain financial triumph and lay the groundwork for a luminous future for yourself and posterity.