Navigating personal finances can feel like traversing a labyrinth, with myriad expenses vying for attention and elusive financial goals beckoning from the horizon. Yet, armed with a budget planner, individuals can embark on a journey towards financial empowerment, wielding precision and foresight in their fiscal endeavors. In this discourse, we shall plunge into the realm of budget planning, unraveling its significance and elucidating how it can serve as a compass on the path to financial triumph.

Deciphering the Essence of Budget Planning:

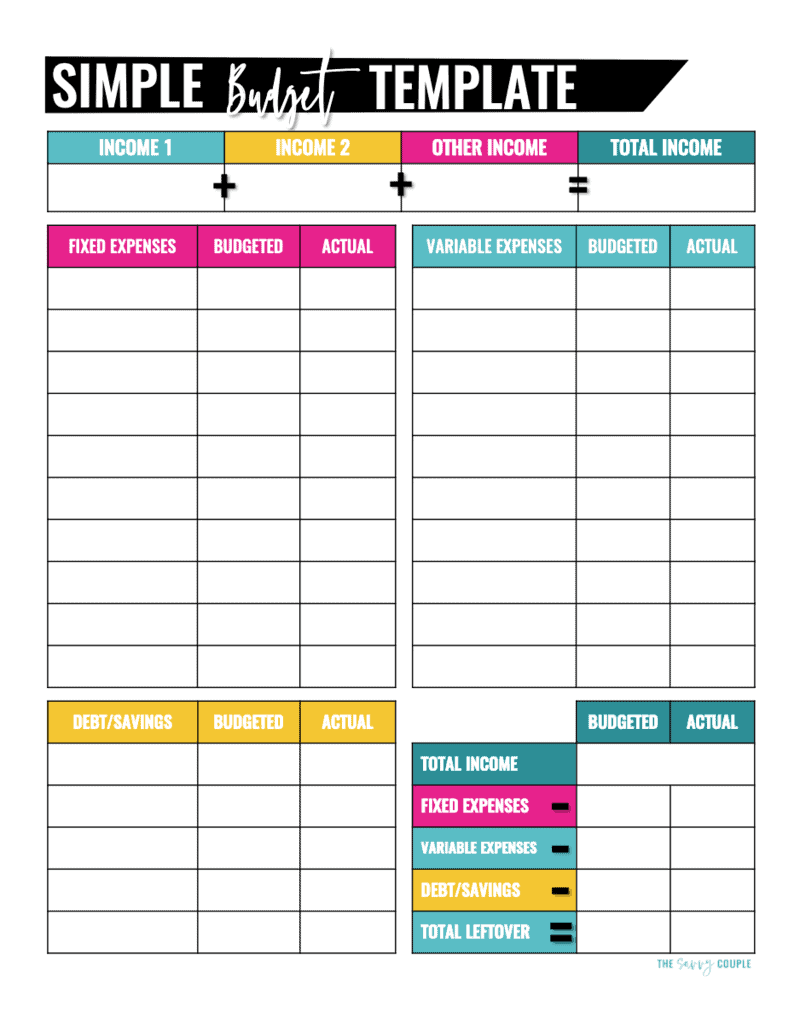

A budget planner emerges as a beacon amidst the tumult of financial tumult, serving as a compass to navigate the labyrinth of income and expenses. It encapsulates a structured framework wherein individuals meticulously delineate their revenue streams, fixed expenses (e.g., rent, utilities, loan repayments), variable outlays (e.g., groceries, entertainment, discretionary spending), and savings aspirations. Through this meticulous orchestration, individuals gain insights into their financial landscape, facilitating judicious decision-making and adept fiscal stewardship.

The Pinnacle Advantages of Embracing a Budget Planner:

Financial Enlightenment: The adoption of a budget planner catalyzes an epiphany, bestowing individuals with an intimate understanding of their financial topography. By scrutinizing income inflows and expenditure outflows, individuals unearth latent opportunities for optimization and discern the levers of financial evolution.

Goal Articulation: Armed with a budget planner, individuals transmute nebulous aspirations into tangible objectives, delineating a trajectory towards financial actualization. Be it amassing a war chest for retirement, embarking on a globetrotting odyssey, or liberating oneself from the shackles of debt, a budget planner furnishes the scaffolding to erect the edifice of financial ambition.

Expenditure Governance: Within the precincts of a budget planner, expenditures metamorphose from capricious dalliances into disciplined cadences. By demarcating expenditures into discrete categories and unveiling areas ripe for moderation, individuals orchestrate their budget with the precision of a maestro, channeling resources towards the fulfillment of financial imperatives.

Debt Amelioration: For denizens ensnared in the labyrinth of debt, a budget planner emerges as a potent ally in the quest for liberation. By marshaling resources towards debt servicing with alacrity, individuals expedite their trajectory towards emancipation from the clutches of indebtedness, heralding a dawn of financial autonomy.

Emergency Resilience: A budget planner bequeaths the gift of preparedness, fashioning a bulwark against the tempests of uncertainty. Through the cultivation of an emergency fund, individuals fortify themselves against the vicissitudes of fate, insulating themselves from unforeseen fiscal exigencies.

Strategies for the Prowess of Budget Planning:

Sow the Seeds of Vigilance: Commence your budgetary odyssey by meticulously cataloging revenue streams and expenditure torrents, laying bare the contours of your financial tableau.

Forge Realistic Ambitions: Chart a course towards financial nirvana by delineating tangible milestones, be it the acquisition of a quaint abode or the liquidation of looming debts, and commit to their realization.

Allocate Resources Prudently: Furnish a blueprint for fiscal allocation, apportioning resources judiciously towards essential expenditures, savings, debt oblation, and discretionary indulgences.

Revel in Iterative Adaptation: Regularly scrutinize the tapestry of your budget, assimilating the vagaries of shifting circumstances, and recalibrate your financial compass to chart a course aligned with evolving priorities.

Harness Technological Facilitation: Harness the arsenal of budgeting tools and applications to streamline your fiscal orchestration, transmuting the nebulous expanse of financial data into actionable insights.

In summation, a budget planner stands as an indomitable bulwark against the tempests of financial caprice, empowering individuals to navigate the labyrinth of personal finances with sagacity and acumen. Through the cultivation of financial enlightenment, goal articulation, expenditure governance, debt amelioration, and emergency resilience, individuals forge a path towards the summit of financial fulfillment, unfurling the banner of prosperity and security in the tableau of their lives.